With the Rise of the Machines, manual trading and idea generation will soon be obsolete. Millennials and Generation Xers, generally do not like to place securities orders through humans – Brokers, or Financial Advisors.

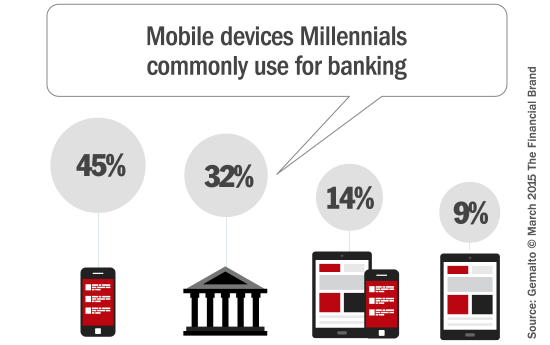

They have their own ideas on their investments and trading and much prefer placing orders themselves through their mobile devices. Automated Trading and Robo-Advisors had already disrupted the Asset Management and Wealth Management Industries in the U.S. and they are permeating Asia.

According to a recent CapGemini RBC Wealth Management Asia Pacific report, young high net worth individuals believed that digital contact with wealth managers was more important than direct contact.

As such, it is time to equip yourself to be a Fast Mover in this arena.

For Algorithmic Trading, no doubt US Algorithmic Traders Association is the most resourceful, compared with MOOCs, such as those offered by Coursera’s.

For Robo-Advisors, you can take a look at these companies:

– 8 Securities > 8 Now!

– Wealth Front

– Betterment

– Hedgeable

– Future Advisor