What’s the buzz with Blockchain? Well, Blockchain is the technology on which Bitcoin functions. By definition, Blockchain is a ledger of all transactions that were executed and is a write-only platform, whereby transactions once executed cannot be modified. It can be further divided into Public and Private blockchains.

Banks are at the Tipping Point of Transformation, streamlining current processes to improve efficiencies. Many banks have setup departments to do experiments on private block chain or semi-public block chains. It is estimated that blockchain technology can help banks reduce infrastructure costs by up to $20 billion a year.

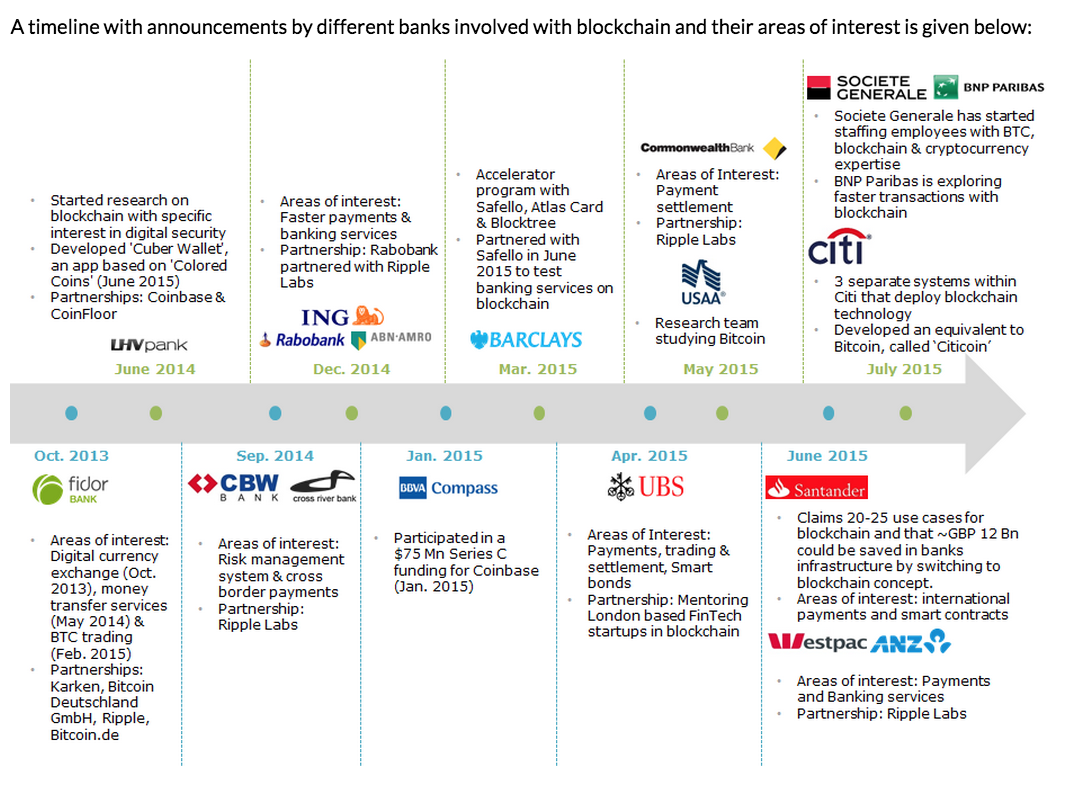

Above is a timeline of different financial institutions that are showing interests in blockchain, Infographic created by Let’s Talk Payments.

A total of 26 different banks that have either partnered with or expressed interest in exploring Blockchain:

– JP Morgan

– Citibank

– Barclays

– Credit Suisse

– BBVA

– Santander

– Lloyds

– BNP Paribas

– Bank of America Merrill Lynch

– HSBC

– Deutsche Bank

– RBS

– Rabobank

– ABN Amro Bank

– ING Bank

– Westpac

– Commonwealth bank

– ANZ Bank

– DBS Bank

– Societe Generale

– Standard Chartered

– LHV Bank

– Fidor Bank

– CBW Bank

– Cross River Bank

– USAA Bank

A report by GrowthPraxis (a payments research firm) has identified 20 Non-Financial Use Cases for Blockchain Technology:

Please Click on the Image to see the Enlarged version:

Blockchain technology allows everyone to hold and make transactions as strangers but in a completely transparent manner. There is no mediator in between two parties making the transaction, and the entire process becomes easier and cheaper. This concept can be applied to the entire digital world, making any kind of exchange/transactions secure.

The different blockchain startups involved are: Ripple Labs, Earthport, GetGems, Everledger, R3CEV, Circle, Safello, Digital Asset Holdings, Symbiont, Coinfloor, Coinbase, Chromaway, Coin Republic, Clearmatics, Kraken, and Bitcoin.de

The concepts that are being explored are: Asset registries, smart contracts, smart shares, smart bonds, trading, cross-border payments and digital payment system, trade execution and settlement, digital security, risk management, post-trade processing services, regulatory reporting, KYC, AML, and faster payments.

Original Source: Growth Praxis and Let’s Talk Payments