Over the past decades, companies and governments have accumulated massive amount of data where algorithms can finally be fully utilized in this new era. Algorithms can help companies recognize patterns, make predictive analysis and decisions in a fraction of a second to outmanoeuvre competitors. Below are lists of FinTechs that are making good use of Algorithms:

FinTech Companies using Artificial Intelligence:

Trading:

– Aidiyia

– Binatix

– Bridgewater Associates

– Castilium

– Cerebellum Capital

– Clonealgo

– KFL Capital

– Rebellion Research

– Renaissance Technologies

– Sentifi.com

– Sinai

– Two Sigma Investments

Lending:

– Flex Funding

– LendingRobot

– Petra Partners

FinTech Companies using Machine Learning:

Lending:

– Affirm

– Lending Club

– Kabbage

– ZestFinance

– LendUp

– Kreditech

Trading:

– Binatrix

– LendingRobot

– Petra Partners

Biometric:

– EyeVerify

– Bionym

Fraud Detection:

– Feedzai

– Brighterion

– Cryptosense

Other Companies using Algorithms:

Direct Market Access (Trading):

– Dash Financial

– WOOD & Company

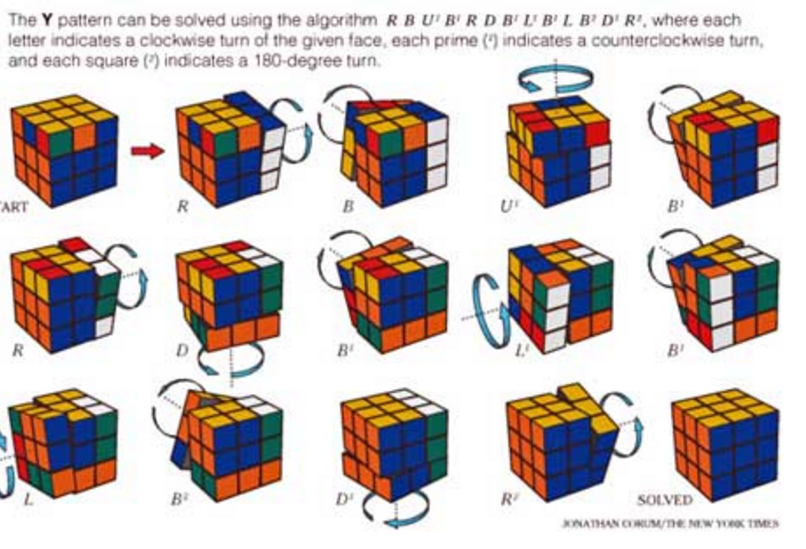

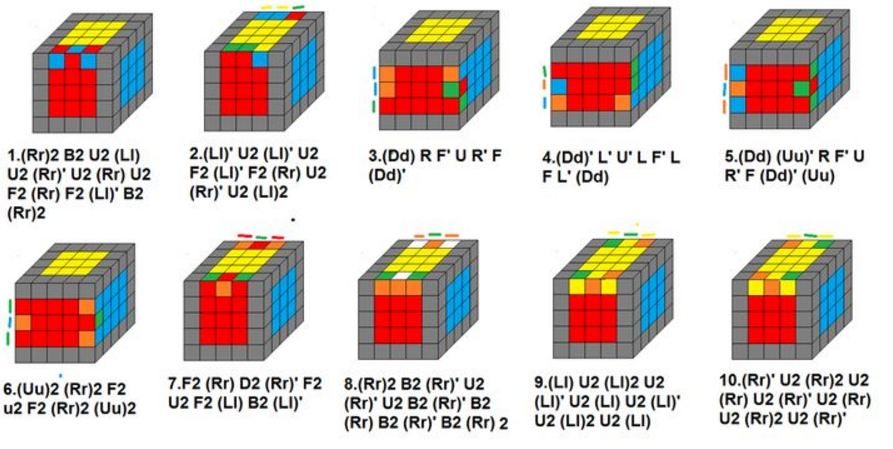

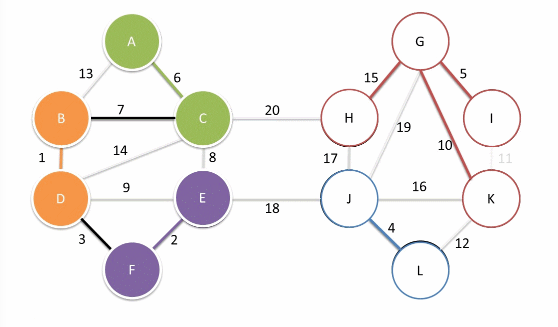

Image Source: Wikmedia Boruvka’s Algorithm, Rubixsolve, Pinimg.com