Launches Four Revolutionary Features

Extends Footprint Across 12 New Countries

– Launches “Going Global” strategy

– First Hong Kong eWallet to allow instant Global Money Transfer, without transaction fees

– Foreign exchange transactions for up to 16 currencies

– Global bill payment support for 14 service categories

– Mobile air-time top-up supporting 64 mobile operators in 10 countries

Mr. Alex Kong, Founder & CEO of TNG Wallet, Hong Kong’s leading eWallet, speaking at a launch and press conference today at the Hong Kong Convention & Exhibition Centre. TNG announced it is rolling our major features to allow Money Transfer, Foreign Exchange transactions, Mobile Air-time top-up globally, and that it is extending its eWallet across 12 countries in Asia.

Hong Kong, 27 September, 2016 – TNG Wallet (“TNG”), Hong Kong’s leading eWallet, held its TNG 3.0 New Product Launch and Press Conference today at the Hong Kong Convention & Exhibition Centre.

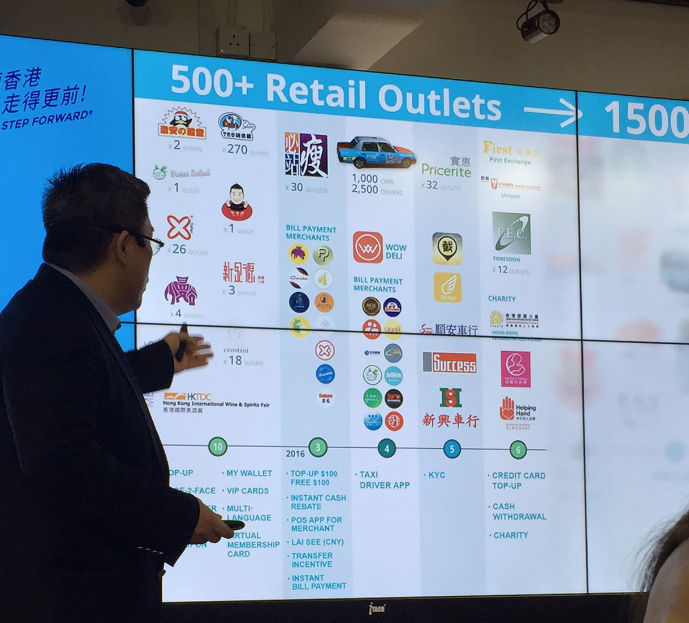

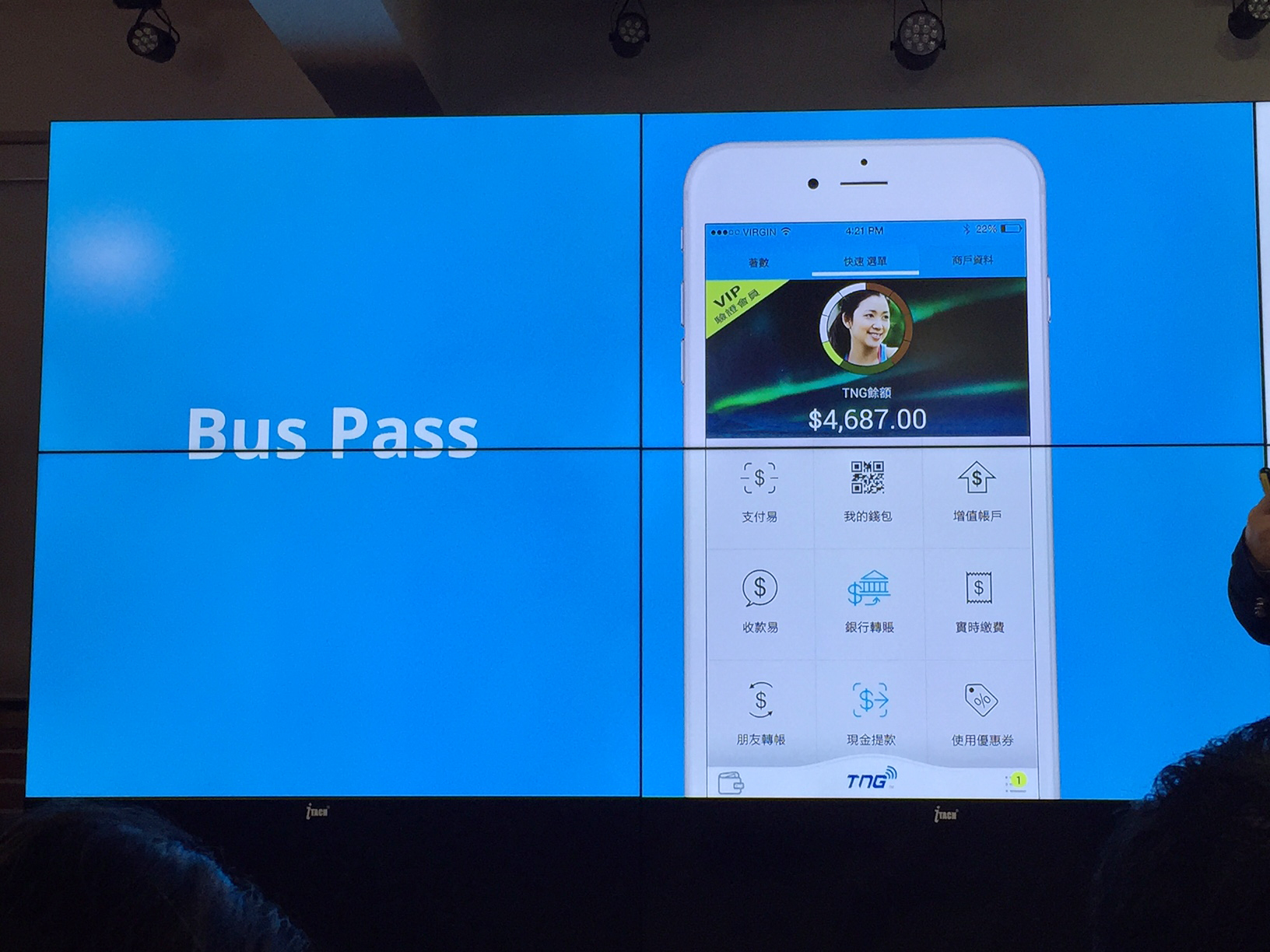

TNG announced four revolutionary features including Global Money Transfer, Foreign Exchange, Global Bill Payment and Global Mobile Air-time Top-up. The new features distinguish TNG from competitors in Hong Kong and help lift the city’s financial technology (“FinTech”) industry to new heights. Bolstered by the strong organic growth achieved in Hong Kong since its launch in November 2015, TNG has set its sights on global expansion.

Global Money Transfer (Real-Time)*

This feature allows TNG users to transfer money from their TNG app to over 800 banks across12 other countries, where up to 80% of the population do not have bank accounts. Once the identification is verified, recipients can withdraw cash immediately at more than 190,000 cash pick-up points. There is no transaction fee for users and TNG promises very favourable exchange rates. TNG is Hong Kong’s first licensed eWallet to offer cross-border financial transactions.

Foreign Exchange (Real-Time)

TNG users can now transact in 16 foreign currencies in real-time at very favourable exchange rates compared to traditional channels. They can collect currencies purchased from any of 27 conveniently located foreign exchange outlets in Hong Kong within three days. Situated along the MTR and railway routes, many of these outlets operate until midnight, 365 days a year, giving users much greater flexibility compared to banks. This will be a major boon to outbound travellers who no longer have to queue at money changers, and can also avoid foreign exchange rate fluctuations.

Global Bill Payment

Many Hong Kong residents who own homes overseas can now make bill payments, without incurring transaction fees, across TNG’s regional network with just a few taps on their phone, anytime, anywhere. The network covers 14 service categories, including electricity, Internet, water, telecoms, utilities, etc.

Global Mobile Airtime Top-up (Real-Time)*

This feature allows TNG users to top up their foreign mobile SIM cards in real-time with 64 mobile operators in 10 countries. Residents and foreign workers in Hong Kong can now add value to their overseas SIM cards through the TNG app anytime, anywhere. They can also pay for or top up family members’ mobile accounts back home.

At the launch attended by hundreds of partners, merchants and potential investors, TNG Founder and CEO, Mr. Alex Kong, announced the establishment of the GLOBAL EWALLET ALLIANCE (“GEA”) covering Hong Kong and 12 countries. This will spur TNG’s global expansion as GEA members can facilitate free flow of transactions with economies of scale.

TNG also unveiled two other lifestyle functions. The first is “Make Money”, TNG’s first gaming function which enables users to earn money by carrying out tasks such as online market surveys. The second is “Salary Payout” which is highly suited for paying domestic helpers and part-time/ casual workers instantly. Both features will have full online transaction records.

“Having begun as a homegrown eWallet, TNG is introducing major new features and embarking on an exciting regional expansion. We are leveraging on our success in Hong Kong to roll out a global roadmap to accelerate our mission to build a global cash-less and card-less eco-system, and to facilitate the adoption of a truly digital lifestyle,” Mr. Kong said.

“I would like to express our heartfelt gratitude to our merchants, business partners and users for their continuous support of TNG so that we can join hands to bring Hong Kong’s FinTech to new heights,” Mr. Kong added.